Tax Benefits Of Living In Wyoming

Feb 162021

We hear from clients frequently that the low tax structure here is a popular motive on why they chose to move to Wyoming. It's true, Wyoming residents get to enjoy some exceptional tax benefits. For this reason, our state continues to top lists such as this Business Insider article on tax-friendly states for retirement.

Wyoming is one of only seven states that don’t have state income tax: the others being Alaska, Florida, Nevada, South Dakota, Texas, Washington. Other tax benefits of living in Wyoming are the lack of corporate income, estate, or capital gains tax. Trusts accumulating income are also not taxed. This is possible because the state has historically used revenues from mineral production and severance taxes to pay its bills. Property taxes and sales tax also supplement state revenue, however the average state and local tax burden for individuals remains low at 7.1%.

Most pertinent to our industry, all Wyoming real estate sales are tax-free. Homeowners can transfer their real estate properties to heirs as a gift too, again free of taxes. Another rare option enjoyed by our state is the Dynasty Trust, which allows residents to pass on their family real estate property while shielding it from federal estate taxes - for up to 1,000 years. This enables multiple generations to retain the products of their family’s hard earned livelihoods and enjoy them for years to come.

Jump to Section:

State Tax Benefits Of Living In Wyoming

Benefits of Retiring in Wyoming

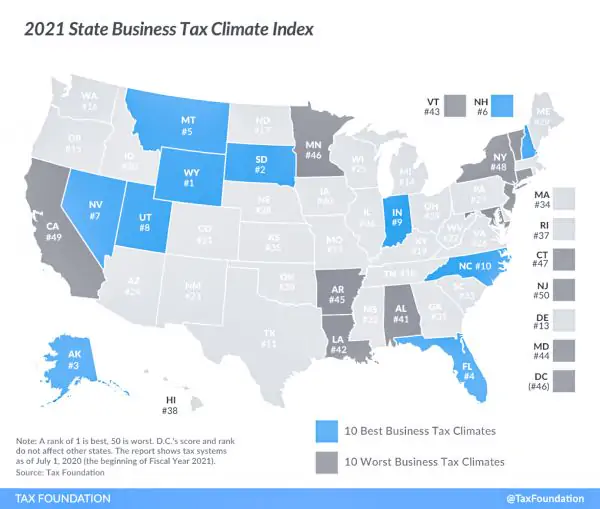

Source: The Tax Foundation (2021)

State Tax Benefits Of Living In Wyoming

- No personal income tax

- No retirement income tax

- No corporate income tax

- No capital gains tax

- No tax on intangible assets such as stocks and bonds

- No inheritance or estate tax

- No gift tax

- No real estate sales tax

- No tax on income from trusts

Source: The Tax Foundation (2021)

Sales Taxes In Wyoming

Wyoming does have a 4% sales tax that applies to nearly all purchases excluding groceries or prescriptions. Of this revenue, the state of Wyoming keeps 69% in its general fund, while the remainder gets sent back to their respective counties. That amount is then divided between the counties and municipalities on a per capita basis.

Counties can add an additional 1% to the sales tax, to total 5% with voter approval. This optional tax is often called the "fifth penny"; at the moment 21 of the 23 counties have this enacted. There is also a "sixth penny" optional sales tax which is designed to fund a special purpose or "capital project". Examples of capital projects would be infrastructure updates, a new library, or replacing utility lines.

Property Taxes In Wyoming

Property tax rates can vary across the state by town and counties, specified by their requested budgets. The state of Wyoming collects an average property tax of just .61% of a property's assessed fair market value. We are located in Park County, which collects an average of .65% and an annual median property tax of $1,243. Teton County collects the highest property tax in Wyoming, levying an average of .48% and an annual median property tax of $3,496.

Tax rates in Wyoming are expressed as "mill levies" which are set by entities like school districts, towns, and counties. One mill equals one tax dollar for every $1,000 of assessed value. So for example, if the total tax rate was 68 mills, your total tax due would be (your property’s taxable value) x (.068) - for more information on calculating your property taxes, visit the Wyoming Property Tax Division.

Source: The Tax Foundation (2021)

Benefits of Retiring in Wyoming

The same tax-free conditions that make Wyoming great for business and real estate also qualify it as a great state for retirement. Retirees stand to benefit from no income taxes along with a lower cost of living. And residents certainly won't have to pay taxes on social security income or out-of-state retirement income. Quality of life here is outstanding with no limit of scenic views with nearby Yellowstone and Grand Teton National Parks. If you are interested in further reading on why Wyoming is a great state for retirees, check out this Business Insider article on retiring in Wyoming, featuring our very own Rita Lovell.

Read Related Articles:

Moving To Wyoming? Read This:| Wyoming Real Estate Market Trends | And The Winner Is Wyoming!

Interested in buying vacant land in Wyoming?

Search our properties for sale or get new listing notifications by creating an account here

If you want to know more about the area, check out our resources for Cody, Powell, Clark, and Park County or ask us about the area! We love Cody and strive to be local experts. Contact us if you're curious about Cody or want to get our area insight before looking at properties.

Follow Us: Facebook | Instagram